"One of the most important qualities of a successful executive from Post Capital’s perspective is a CEO’s willingness to get “their hands dirty” – a leader whose first inclination is to fix a broken window on his/her own instead of calling maintenance."

Chris Cheang Tweet

Meet Chris Cheang, Director, and Head of Business Development.

Post Capital Partners is a private investment firm that makes both minority growth and control investments in businesses with repeat or recurring revenue models. Post Capital primarily employs an “Executive-First” deal sourcing and investment strategy in which it first identifies and partners with talented senior operating executives and then works proactively with those “Executive Partners” to identify investments.

In addition to “Executive-First” platform searches, Post Capital also pursues management buyouts and growth capital investments. Based in New York City, Post Capital invests a committed capital fund with top-tier institutional and sophisticated private investors.

Check out more interviews with entrepreneurs here.

WOULD YOU LIKE TO GET FEATURED?

All interviews are 100% FREE OF CHARGE

Table of Contents

Thank you so much for giving us your time! Before we begin, could you introduce yourself to our readers and take us through what exactly your company does and what your vision is for its future?

Chris Cheang: I am a director and head of business development at Post Capital Partners, an executive-driven private equity firm. I’ve been with the firm for more than 12 years and have taken on many different roles and responsibilities. My main focus over the last several years has been on sourcing new investments and meeting with talented executives who are looking to run their own companies. I also empty the dishwasher most mornings.

Prior to joining Post Capital, I was on the management team of a Chinese American joint venture headquartered in Shanghai (Cabot China). Before Cabot China, I started my career as a very tired financial analyst at Adams Harkness, a boutique full-service investment bank based in Boston.

NO child ever says I want to be a CEO/entrepreneur when I grow up. What did you want to be and how did you get where you are today?

Chris Cheang: Three key lessons have really stuck with me throughout my career and they are each connected in many ways and very basic:

- Don’t be a jerk. I learned this from my first boss in investment banking. And his point was beyond the obvious one of making sure you treat everyone with respect. What he really meant was “pick your spots” – you don’t have to scoop up every last dollar on the table (especially if you’re already ahead) or win every last negotiating point. You can be successful without being a jerk.

- Know when to keep your mouth shut. This is a multi-layered lesson. Sometimes it can mean that you should keep your mouth shut so you can listen better. It can also mean that you should remain quiet so your teammates (particularly the junior members of the team) have space to insert their ideas and opinions.

- People do business with people they like. Getting an M&A deal done can be a very intense, stressful, long and laborious process. Building relationships with companies and executives over time and being open and candid with those you meet can help support your business dealings in the long run. No one has ever said they would like to partner with someone they don’t like or trust.

Tell us about your business, what does the company do? What is unique about the company?

Chris Cheang: Post Capital Partners is a private investment firm that makes both minority growth and control investments in businesses with repeat or recurring revenue models. The company employs an “Executive-First” deal sourcing and investment strategy in which we foster long-term partnerships with executives and work with them to source and identify businesses that are a fit for their executive talent and experience.

How to become a CEO? Some will focus on qualities, others on degrees, how would you answer that question?

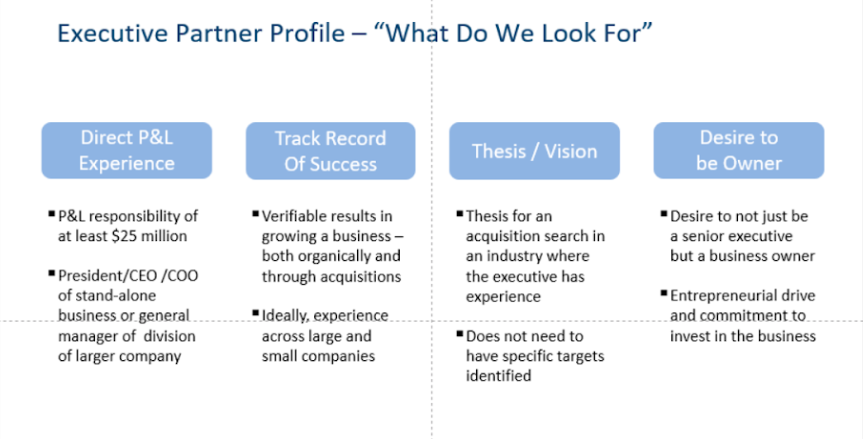

Chris Cheang: In the context of this interview, below are some of the characteristics we look for in an executive that we want to partner with.

What are the secrets to becoming a successful CEO? Who inspires you, who are your role models and why? Illustrate your choices?

Chris Cheang: One of the most important qualities of a successful executive from Post Capital’s perspective is a CEO’s willingness to get “their hands dirty” – a leader whose first inclination is to fix a broken window on his/her own instead of calling maintenance. This is particularly important with lower mid-market businesses because the depth of the management team outside of the most senior leader is often limited. Capable, action-oriented senior leadership (especially in the early stages of the investment) and involvement is paramount.

One of my favorite examples of a CEO getting his hands “dirty” is Roscoe Smith, our first ever Executive Partner and CEO. We partnered with Roscoe to acquire Agent Media, an insurance marketing services business based in Florida, just before a hurricane struck the state. Thankfully the Agent Media team was safe and the office was intact but the building was struggling with intermittent power. On the drive down from South Carolina, where Roscoe was based, to Agent Media’s offices in Florida ahead of the closing, he stopped at nearly every WalMart and Costco on his route to purchase extension cords, fans and bottled water. He arrived the day after closing the transaction fully prepared to keep the business running (literally) and drive it forward. This example is a representation of true leadership.

Many CEOs fall into the trap of being all over the place. What are the top activities a CEO should focus on to be the best leader the company needs? Explain.

Chris Cheang: At Post Capital, we work with CEOs at middle market firms to run and grow these companies. In our experience in working with executives, they need a compelling investment thesis grounded in their own industry experience, the commitment to pursue a dedicated acquisition search and the leadership skills and operational expertise to grow the business. With these ingredients, an executive is well positioned to be both a successful business leader and CEO.

The Covid-19 Pandemic put the leadership skills of many to the test, what were some of the most difficult challenges that you faced as a CEO/Leader in the past year? Please list and explain in detail.

Chris Cheang: Across the board, all of our CEOs in our portfolio companies did an outstanding job navigating the pandemic. As a CEO working with a private equity firm, one of the key advantages is having a built-in network of other CEOs to connect with and potentially collaborate. This dynamic was particularly true during the pandemic. Multiple companies within our portfolio worked together during the pandemic to fill capacity needs and make customer and vendor introductions that helped stabilize and better position each business during the pandemic and going-forward.

In your opinion, what changes played the most critical role in enabling your business to survive/remain profitable, or maybe even thrive? What lessons did all this teach you?

Chris Cheang: In the context of being a CEO of a private equity-backed company, a good private equity partner should bring more to a company than capital. A PE firm should be able to leverage its network to make relevant customer and supplier introductions, all of which can help grow the business and drive significant value.

In addition, a private equity firm has deep expertise in working with lenders, which can provide more capital to the business at better terms. PE firms can also greatly assist in doing add-on acquisitions, which can create step-change improvements in scale (i.e. through expanding the customer base, introducing cross-selling opportunities) and profitability (i.e. through cost synergies) of the business.

What is the #1 most pressing challenge you’re trying to solve in your business right now?

Chris Cheang: One of the top challenges for us at Post Capital is meeting talented executives that fit our Executive-First model. There are many talented executives with great track records but not all of them have visions for their industry and the entrepreneurial drive to pursue them.

Of course, we welcome conversations with all types of executives, but the really exceptional executives are the ones that not only have an investment thesis, but also have an overriding desire to be a business owner in their next venture above all other job opportunities. We want to meet these executive and partner with them. Through this partnership, we will leverage our sourcing and transaction processing capabilities to find businesses that we can all get excited about and invest in.

You already shared a lot of insights with our readers and we thank you for your generosity. Normally, leaders are asked about their most useful qualities but let’s change things up a bit. What is the most useless skill you have learned, at school or during your career?

Chris Cheang: Through the years, I have accumulated an untold number of Excel shortcuts (WAY beyond Ctrl+C and Ctrl+V) that are totally useless outside the narrow world of finance.

Jed Morley, VIP Contributor to ValiantCEO and the host of this interview would like to thank Chris Cheang for taking the time to do this interview and share his knowledge and experience with our readers.

If you would like to get in touch with Chris Cheang or his company, you can do it through his – Linkedin Page

Disclaimer: The ValiantCEO Community welcomes voices from many spheres on our open platform. We publish pieces as written by outside contributors with a wide range of opinions, which don’t necessarily reflect our own. Community stories are not commissioned by our editorial team and must meet our guidelines prior to being published.