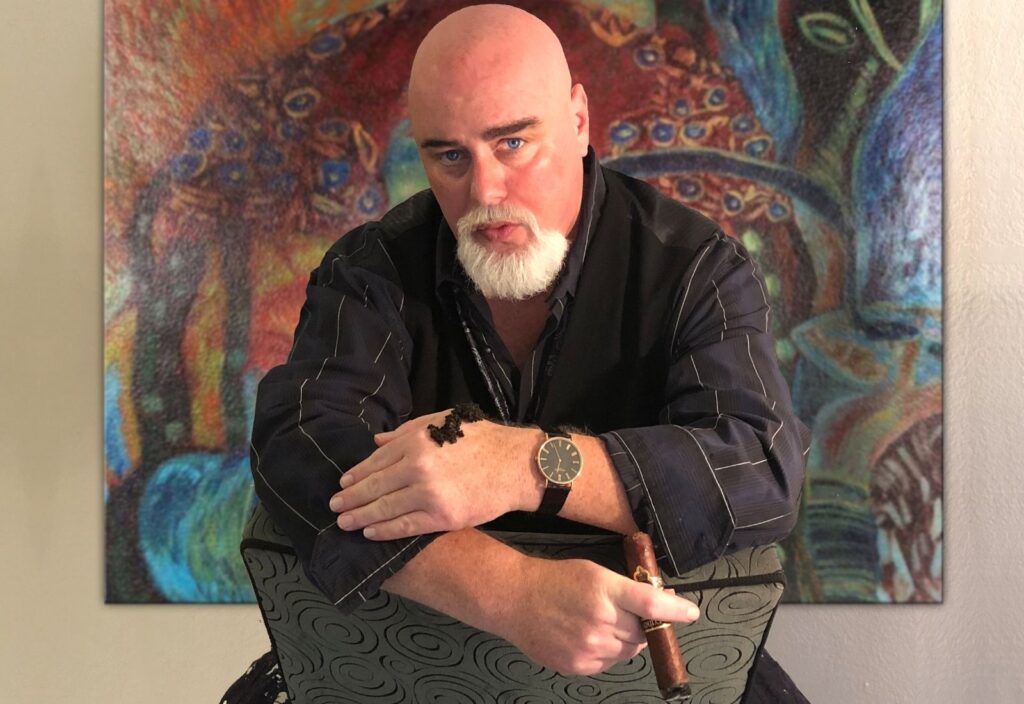

The American “King of Luxury” is quite the apt title for Vin Lee the man behind the Grand Metropolitan — the Beverly Hills-based premier luxury goods holding company that, in 2021, manages a $7 billion portfolio filled with over 60 luxury brands.

But, who exactly is Vin Lee?

If we follow him through his “road to riches”, you’ll find that (through determination and astoundingly consistent inventive prowess) Lee had actually been a self-made millionaire from as early as his late teens!

His ambitions continued to follow him through the next few decades as well. To the point that, before he was even of the legal age to drink alcohol, he was already personally overseeing and managing respectable brands of worth.

One thing’s for sure, very few of what surmises as the ‘young crowd’ these days have his worth ethic and “oversized ambition” (as Lee himself likes to call it with good humor.)

Now, fast-forward a little bit to the 1990s where (immediately after flipping around the Grand Traverse Resort and visiting an established jewelry business called DuQuet Jewelers for his ever Rolex) Lee made his first investments into the jewelry industry. At this stage, we can see a little better just how he was able to get to where is today — with his show-stealing jewelry merchandise adorning many Hollywood stars, celebrities, royalty, heads of states, and everyone else in between!

But okay, enough history talk. How about we actually get to know the man and let him speak for himself?

Stick around for an in-depth look at the mind and the heart behind the rather impressive title of “King of Luxury”:

Jerome Knyszewski: Vin Lee, Beverly Hills magazine has dubbed you the “King of Luxury,” and several other publications have embraced the title. It would have been easy to let that get to your head! However we’ve been interacting on Linkedin for 5 years now (I checked) and even though you own an empire, you are approachable, down to earth and generous, how do you keep yourself grounded?

Vin Lee: That is very kind and generous of you just like the moniker I have picked up along the way. I have to say I did get a secret thrill out of hearing it. Honestly its easy to stay humble because I know of 2-3 French men that really deserve the title far more than I do unless there is a little asterisk next to my name adding *American. Certainly LVMH, Kering, and Richemont are several multiples larger than Grand Metropolitan.

There is a misnomer that people of a certain background or status are somehow insufferable egomaniacs or unpleasant to be around. Its really more of a measure of how they attained their status. You must make the distinction between success and wealth. I know a great many wealthy people who are terrible company, because they haven’t earned their post. Successful people do not have to be rude or arrogant. If you have great wealth because the stock price of your enterprise has been driven up on an idea you stole from others, perhaps you’ll be much more insecure and defensive in the company of others (or on twitter).

For most of my life I have worked very hard to be the best I can. And that includes keeping myself in check as to who I really am. Of course it helps when the people around me in my personal life are not impressed by me at all.

Jerome Knyszewski: None of us are able to achieve success without some help along the way. Is there a particular person who you are grateful towards who helped get you become AND remain who you are? Can you share a story?

Vin Lee: I have been incredibly fortunate to have met and interacted with some of the most powerful and successful people in the world. There is a short list of billionaires and dignitaries I could rattle off, name dropping my association with them as cause for why Grand Metropolitan has survived a recession and a pandemic. And it is true that over the last 30 years I have increasingly been in the company of the Forbes 400. But I think for your readers that would be an unfair spin on reality and somewhat discouraging. I know it would if I was starting out wondering the same thing.

It would be inaccurate to describe any of them as mentors but more like examples. I started my “career” in 1988 the same time frame that billionaires Bernard Arnault (LVMH), François Pinault (Kering) and Johann Rupert (Richemont) were embarking on their journeys. So while my friends and school mates were memorizing sports figure statistics, I was reading Forbes, Fortune, Robb Report, and WSJ about these men and their rampage of acquisitions across the luxury landscape.

A few years earlier it was Don Johnson in Miami Vice and Eddie Murphys’ Beverly Hills’ Cop that introduced Middle America to luxury brands from Ferrari to Patek Phillipe. Rodeo Drive would become my mecca. But it would take iconic images of Gordon Geckko, Thomas Crown, and Edward Lewis who gave us the glimpse of how to get there.

The affluent community we grew up in didn’t even have a Ferrari dealership or a Cartier or Tiffany. We were fortunate to have a Lord & Taylor at our mall across from a Bailey Banks & Biddle. But it was during this period that Michigan based Ford Motor purchased Aston Martin, Jaguar, and Land Rover and Chrysler Corporation bought Lamborghini from the Mimran Brothers for $50 million. I would meet Sotheby’s chairman billionaire Alfred Taubman who had his local offices just a few miles from my own. His presence and reputation would have a huge impact on who I have worked hard to become.

Jerome Knyszewski: Your first acquisition, at age 22, of DuQuet Jewelers, a leading fine jeweler in Michigan, launched you into your amazing mergers and acquisitions career. Tell us more about how you stumbled upon the opportunity and what advice you would give to anyone contemplating a first acquisition.

Vin Lee: It’s a rather exhaustive story towards my path to DuQuets that had started 8 years prior. Fast forward ahead, I was awarded a contract to turnaround the fortunes of the legendary Grand Traverse Resort and fabled Jack Nicklaus Golden Bear golf course. Management had accrued over $80 million in construction and operating debt to the City of Detroit Pension Fund. The 4 year $50 million ($100 million today) contract included $3.6 million per annum and 22% of gross revenue.

As a reward to myself I wanted to purchase a Rolex president to marque the moment. I was certainly not a humble young man and boasted about all I had done and earned. The owner took me into the private diamond room and regaled stories of sex and influence in the diamond industry. I invested $800,000 of my Grand Traverse deal to acquire DuQuet Jewelers. I would forever be a buyer from that point on.

Being a buyer is a far easier vocation than being a seller, especially if you are not requiring the operation to pay down the debt of acquisition or paying your bills. All of our deals have always been closed with cash. It is in fact the debt-service of these companies that put them in play in the first place. Economic downturns, shifts in the dollar or the yen, pandemics, or simply mismanagement of resources to please shareholders.

My advice to anyone interested in acquisitions is trite. Be wealthy first. Not borrowed lines of credit or multiple partners/investors with terms. Everything you plan will take 3 times longer and cost twice as much as anticipated. It is in fact a rich man’s game.

Jerome Knyszewski: Owning such an eclectic empire is no easy feat! How would you describe your work-life balance? Can you share how you keep it all in harmony? What advice would you give to entrepreneurs to avoid a burn out?

Vin Lee: My path has been quite unique, if I may. I was very fortunate to be engaged in large projects as a teen. The trajectory of our growth has been very layered and prolonged over 30 plus years. If a professional manager were to take over my position today it would be quite a learning curve. I say this not to be boastful or dismissive but to point out that one has to live this life rather than just accept it as a job or position.

The language of luxury is not something everyone is able to learn. The industry is very small and comprised of thousands of brands across hundreds of categories. Of course operationally, owning one jewelry store is a full time occupation, a jeweler. Owning 1,000 does not require an order of magnitude it is simply a different set of skills and priorities. I haven’t changed a watch battery or resized a wedding band in three decades. And I have never harvested caviar or rolled tobacco into cigars.

If you take a step back you will see they are all luxury and lifestyle brands that work together brilliantly with the help of many talented and uniquely creative people. While our diamonds are busy on the red carpets, the caviar and cigars are at the after parties hosting guests on our custom furnishings in the company of exotic cars and fine art. Are we saving the world? No. But we are helping thousands of people to support their families and live out their own dreams. Sometimes that’s enough.

When I was working to acquire Finlay Enterprises during their bankruptcy, it was the hardest period of my life. My personal life was in complete havoc and I hurt people I loved most by my absence. I wanted so bad for my work-life balance to shoot to the moon simultaneously. That never happens. You don’t get to marry the girl of your dreams on the day you win the lottery. So after a great deal of anguish I pivoted my focus on something else, letting go of everything I was banging my head against.

In the end, you don’t have to do this. You don’t have to accomplish your dreams or your goals. You’ll be alright if you don’t. If you are doing this all for money. Forget it. You’ll never find satisfaction. If you are doing this to impress a pretty girl so she will fall in love you, she will be gone before you get there.

Jerome Knyszewski: You are the owner of Grand Metropolitan, a luxury group portfolio of 100 brands including jewelry behemoths such as Finlay Fine Jewelry, Heilig-Meyers furniture, world renowned art broker Gallery Rodeo, Beverly Hills Sports Car and Cigar Clubs and Pushkin Caviar. What’s next? What markets are you interested in?

Vin Lee: I know a lot of young CEOs and billionaire personalities who would answer that question with crypto. As the Paypal mafia attempts to attach themselves to every new fad to keep their name trending in the media. In my opinion its all arbitrage no matter what currency you use. For the short term we will be focusing on integrating our brands into a digital platform for the new economy introducing new products and financial vehicles.

After a failed attempt to acquire Lord & Taylor and Art Van Furniture during the pandemic, we have one more target operation in Southern CA to be made by Beverly Hills Sports Car. In the more remote future, we have plans for offering international payment services over cellphones in third world countries that includes microloans and leasing.

I also have a new project I designed over 30 years ago in the healthcare industry. The patents filed in 2021 and we should go into production this summer. It is the most ubiquitous product I have ever created and I am expecting a $30 billion market cap. Just like the premise behind “Undercover Billionaire”, I am not using any resources or capital to patent, create, and launch. I decided during the pandemic to do this. A normal person with an idea scraping together the funds to start a new business just like when I was 18.

Jerome Knyszewski: Extensive research suggests that “purpose driven businesses” are more successful in many areas. When your company started, what was its vision, what was your purpose then and what is it now?

Vin Lee: I have to say I have always been purpose driven. My professional career was never about lets open a thing and work so we can pay our bills and do it all over again tomorrow. Now when I first started out, I simply wanted to create something no one had ever seen before. And drive a Fiero GT.

When I acquired DuQuet Jewelers, we remodeled the showroom and I took a office in the back amongst the stacks of industry publications. I spent much of my time thumbing through National Jeweler and Modern Jeweler absorbing decades of design trends and industry transactions. Most prolifically how Zale corporations M&A of dozens of players throughout several bankruptcies created the largest jewelry entity in the United States. I wanted that.

At the same time I would meet with fellow billionaires Sumner Redstone and Blockbuster’s H. Wayne Huizenga about my patented marquees for the entertainment venues. Sumner’s National Amusements was one of the largest movie theatre companies in the world that had just spent $3.4 billion to acquire Viacom, an entity several times larger than itself. A feat that I had no comprehension was possible until he outlined it for me. A few years later he acquired Paramount for more than $10 billion and added CBS to the portfolio in 1999 in a deal valued at $37 billion.

Also at the time, Blockbuster Home Video was buying up hundreds of video stores across the United States rebranding them as Blockbusters. This practice is known as an industry roll-up. I got a front row seat at the feet of the master of three industries Auto Nation, Blockbuster, and Waste Management. Like my contemporaries at the time emulating sports figures, I would take these examples and employ them for the next 30 years in fine jewelry, home furnishings, tobacco, and caviar.

Jerome Knyszewski: You have worked with a number of celebrities, Prince, P. Diddy and Christina Aguilera, Jennifer Lawrence to Kellyanne Conway, and I’m sure I’m missing many (who?) do you have an anecdote you can share about a celebrity that touched you?

Vin Lee: As large of a city as Los Angeles (Beverly Hills) is, you would be surprised how small the community can be if you are in the right circle. These are circles and situations that you cannot buy your way into either. When I first moved Grand Metropolitan out to Southern CA I became a CEO/partner in The Bohle Company, a large public relations agency with the reputation as the first firm billionaires Bill Gates and Steve Ballmer hired to introduce DOS to the world for Microsoft.

The agency was also a long time advisor to much of Silicon Valley. Bohle’s client list boasted most of the studio network and high powered influencers including billionaire Beny Alagem, owner of Packard Bell and Beverly Hilton Hotel and the Waldorf Astoria Beverly Hills (with Guggenheim). This relationship would provide backstage access with Dick Clark Productions to most of Hollywood and its red carpet events and the acquisition of the Beverly Hills Cigar Club and Gallery Rodeo.

The Beverly Hills Cigar Club is an exclusive private social club, considered a Top 5 Must Have Memberships by Playboy Magazine. The membership is limited to 2,000, starts at $50,000/year. It has been closed for 15 years almost since launch. While discretion is our highest priority, we provide VIP access to most of the celebrity driven events around the globe to our membership.

In addition to the parties, our client is invited to participate in some of the finest products from around the world including our own LOUIXS brand cigars. The average tobacconist sells between 300,000-500,000 cigars a year to a wide variety of retail and wholesale outlets. Our entire production is exclusive to our membership and one of the top cigars in the world. In addition, Gallery Rodeo and Beverly Hills Sports Car are exclusive services for members and guests.

I could tell you about the time I bogarted the last chocolate souffle from Warren Beaty at the Polo Lounge in the Beverly Hills Hotel, but that might make some people unhappy. I told the concierge that I would be willing to sell it for $500. Upon hearing this, he burst out of his booth and the hotel with his entourage. Access is more valuable than money or fame.

It was the 59th edition of the International Cannes Film Festival in Cannes, southern France, May 24, 2006. Mazarine Marie Mitterrand Pingeot, the daughter of the former French president François Mitterrand was to wear our $3 million diamond suite on set for Good Morning London and then on to a film premier and red carpet walk to the premiere of US director Sofia Coppola’s film ‘Marie Antoinette’ at the 59th edition of the International Cannes Film Festival in Cannes, southern France, 24 May 2006.

Two of my body guards were assigned to accompany her throughout the evening. When the car pulled up, she had a terrible decision to make as there was no room for her escorts along with security. The car pulled away with the diamonds safely around her neck, a guard on each side and her disappointed companions on the side of the Boulevard da la Croisette.

As the world watched her on their television screens and in the company of the rich and famous that evening, I felt like I was finally a world class jeweler. Almost 15 years later, I still get a thrill out of seeing my designs on celebrities in film, television or on stage whether we produced them or licensed them to others.

Jerome Knyszewski: With Malls being converted into housings, shops closing, the experience of a diamond ring on a finger, its sparkle is quite an irreplaceable experience. How are you adapting to the times we live in?

Vin Lee: One of our local malls had 11 jewelers and several department store anchors. Not one of those independent jewelers is still open.

Unfortunately, the slow demise of the mall and retail experience at large has been in a slow spiral for many decades. If Grand Metropolitan brands had every one of its retail locations opened right now it would number 100,000 employees working out of 5,000 locations, earning $12 billion across home furnishings and fine jewelry alone. That’s more than half the size of Blockbusters real estate foot print at its peak in 2004 and double the size of Signet Jewelers today.

OK so what does that mean? Well corporate America was once measured by parking spots, corner offices, desk size and head count. Amazon and the internet didn’t destroy American retail, corporate America did. In fact it is the internet that saved American retail especially in the last few years.

Finlay was finally able to acquire Samuels’ Jewelers which once raked in $200 million from 200 locations as the 5thlargest jeweler in North America. It has changed hands several times shrinking each time. Today inside of the Finlay family Samuels actually has a chance sans showrooms and debt service to return to its former glory and $200 million in revenue. Especially given the retail jewelry pie continues to get larger and recent world events have eliminated so much of the weaker competition.

The human condition is adaptability. How you purchased your engagement ring may have changed but not from who. Love will find a way.

Jerome Knyszewski: I like to collect glasses, Moscot, Tom Ford, Cutler, I can imagine acquiring Vin Lee specs or other branded items. You have tremendous resources, an outrageously successful career, a great name, -easier to brand than mine 🤪- yet you keep a low profile, why is that?

Vin Lee: I have been on a yacht(theirs) in Venice with Brad and Angelina, a jet (mine)with Brian Green and Megan Fox, Putin’s Red Square during the G8 and sitting in my car for 5 hours during the Oscars 1 mile from my house at the Beverly Hilton Hotel. Fame is a fickle mistress. Easy to seduce, but even easier to lose. Do you remember how hot Don Ed Hardy were 15 years ago selling just under $1 billion a year? I think they sell now at Sam’s Club next to the produce. How about Tommy Hilfiger who hasn’t made any real money from his eponymous brand in 17 years since he sold it. I think they still sell at Sears if you can find one unlocked.

I wanted to be the next Harry Winston for a minute, but when I found out he essentially died broke I thought better of it. It takes a different kind of ego to put your name on the door like that. I think I have yet to find something I am so religiously dedicated to that I would brand it with the “Lee” name.

Jerome Knyszewski: What is your most prized possession? Share with us why? I have the feeling it’s not something extravagant, and its story is special.

Vin Lee: That’s quite a question. I have to consider this audience here. I am going to automatically disqualify intimate personal effects from my family in this forum. Well I have a rare Patek Philippe Sky Moon Tourbillon ref. 5002P that I got when we closed on Finlay Fine Jewelers. The centerpiece of the Rodeo Collection is an original portrait sketched and signed by Gustav Klimt.

We do not have an exact date of the piece. Klimt is perhaps most famous for his gold leaf work entitled The Kiss and duo Portrait of Adele Bloch-Bauer which sky rocketed the artist to international popularity selling for $285 million. I find his work often intimate and fanciful. We also have a portrait sketched by Klimt that I bought at auction. It’s a very personal piece for me.

Perhaps the early casting I have was by Auguste Rodin when he was apprenticing under Albert-Ernest Carrier-Belleuse between 1864-1870. Or finally, my Courvoisier Erté Collection, The bottles were designed by Russian deco-artist Erté and contain an extraordinary blend of precious Grande Champagne cognacs from château Courvoisier. These are all very nice collectors trappings and yet none of them compare to the butane lighter I have from Fabio Lamborghini as we toured the factory after hours. My cigars, his family’s vintage. It was like walking with the Pope on Holy Land. But again it really is lacking any heart.

Most everyone who knows me would say that I am a very sentimental person. In fact much of the time my feelings and emotions have been my kryptonite especially with loved ones. When I little, I went to a private Catholic school where I served as an alter boy several times a week at morning mass before class. My father would wake me up and while he showered and shaved I would make us egg on toast for breakfast before he took me to church. When my parents sold their house and retired to Naples, FL, I made sure I rescued the aluminum lid that I had used a thousand times as a boy. It remains on my stovetop nearly 50 years later and I use it daily.

Jerome Knyszewski: Describe your perfect moment: where, with whom, what music in the background, which beverage in the glass, is there a plate, if so, what’s in it?

Vin Lee: I think it is easy to assume my answer would be something exotic and fabulous like a moonlit night in the hot tub with candles and champagne and finger foods with that special someone. Or enjoying a Fatburger and shake in the valley in the middle of the night with 80s music playing on the over head speakers.

But as I crowned 50 recently, I think that my perfect moment going forward would be a Christmas Eve around the tree with my loved ones, family and friends. I have never been able to put that together with my parents and my brother all under the same roof. The way it was when we were growing up. That is the goal I have set for myself while my parents are still here with us.

Jerome Knyszewski: Thank you so much Vin for being such an inspiration