Investment Mastery

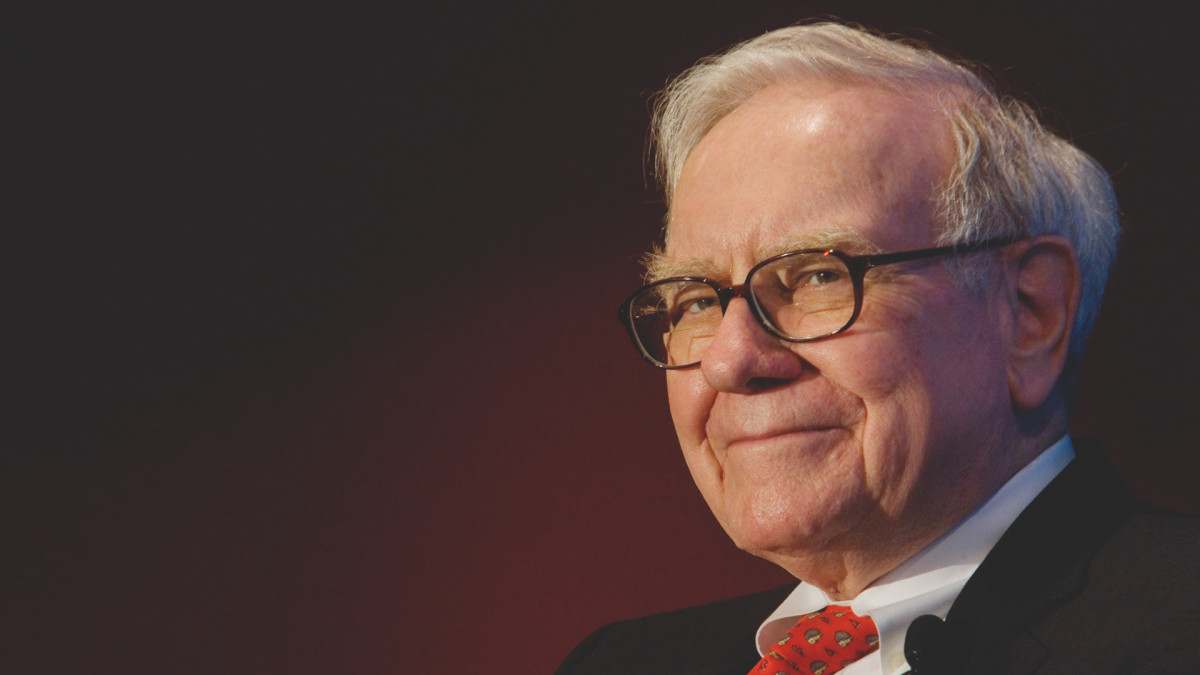

Warren Buffett: An Introduction to the Legend

Warren Edward Buffett, born on August 30, 1930, in Omaha, Nebraska, is widely regarded as one of the greatest investors of all time. His success in the financial world has earned him the moniker “Oracle of Omaha.” With a net worth of over $100 billion, Buffett’s investment mastery has captivated the world and inspired generations of investors.

The Path to Investment Greatness

Buffett’s journey to investment greatness began in humble circumstances. Born on August 30, 1930, in Omaha, Nebraska, Buffett displayed an early interest in business and finance. From a young age, he devoured books on investing, laying the foundation for his future success as one of the most successful investors in the world. Buffett’s journey from a paper route and pinball machine business to becoming a billionaire investor is a testament to his relentless pursuit of knowledge and determination to excel.

Early Life and Formative Experiences

Childhood and Influences

Buffett’s childhood experiences played a pivotal role in shaping his investment mindset. Growing up during the Great Depression, he witnessed firsthand the devastating impact of economic downturns. This instilled in him a conservative approach to finance and a deep understanding of the importance of preserving capital.

Buffett’s father, Howard Buffett, a stockbroker and U.S. Congressman, also played a significant role in shaping his investment philosophy. His father’s guidance and exposure to the world of investing ignited Buffett’s passion and set him on a lifelong path of financial mastery.

Entrepreneurial Ventures and Early Investing

His entrepreneurial spirit emerged early on. In high school, he began several ventures, including selling golf balls and delivering newspapers. These experiences honed his business acumen and taught him essential lessons about profitability and risk.

During his college years at the University of Nebraska-Lincoln and later at Columbia Business School, Buffett further refined his investment skills. He studied under renowned value investor Benjamin Graham, who became his mentor and greatly influenced his investment philosophy. Graham’s teachings, particularly the concept of value investing, became the cornerstone of Buffett’s investment approach, propelling him to become one of the most successful investors in the world.

Embracing Graham’s principles, Buffett sought to invest in companies with strong fundamentals, solid management, and a fair company value relative to its market price. This disciplined and analytical approach formed the bedrock of his investment strategy, enabling him to identify both undervalued stocks and opportunities and make sound investment decisions.

Buffett’s Investment Philosophy

Patience and Long-Term Vision

One of the key factors that differentiates Buffett from other investors is his extraordinary patience. He is known for holding stocks for extended periods, sometimes for decades. This patient approach allows him to capitalize on the power of compounding returns over time.

Buffett believes that short-term market fluctuations are noise and that true wealth is accumulated by investing in exceptional businesses for the long haul. He once said, “Our favorite holding period is forever,” emphasizing the importance of having a long-term perspective when it comes to investing.

The Power of Compound Interest

Warren is a firm believer in the power of compound interest. By reinvesting earnings and allowing them to compound over time, he has achieved extraordinary wealth growth. This concept highlights the exponential growth potential that arises when investment returns are reinvested and multiplied over an extended period.

His disciplined approach to reinvesting dividends and capital gains has significantly contributed to his impressive track record and the compounding of his wealth.

Berkshire Hathaway: A Transformative Acquisition

The Berkshire Hathaway Story

One of the defining moments in Buffett’s career was the acquisition of Berkshire Hathaway. Initially a struggling textile company and struggling textile manufacturing company itself, Buffett saw an opportunity to deploy his investment skills and transform it into a conglomerate, benefiting not only himself but also the Berkshire Hathaway stakeholders.

In 1965, he began acquiring shares of Berkshire Hathaway, ultimately gaining full control of the company. While the textile business eventually faltered, Buffett redirected Berkshire Hathaway’s focus towards investments in other industries, using the holding company more as a vehicle for his investment endeavors. This strategic shift not only allowed Buffett to showcase his investment prowess but also created value for the Berkshire Hathaway stakeholders, including shareholders, employees, and business partners.

By diversifying the company’s portfolio and making shrewd investment decisions, Buffett expanded the company’s reach, profitability, and influence, enriching the lives of those associated with Berkshire Hathaway. The success of the company first investment, under Buffett’s leadership has been instrumental in creating wealth and opportunities for the stakeholders of wonderful company who have reaped the rewards of his investment mastery.

Shrewd Investments and Strategic Acquisitions

Buffett’s investment prowess became evident as he made strategic acquisitions and investments under the Berkshire Hathaway umbrella. He targeted businesses with strong competitive advantages and sustainable growth prospects, often acquiring them at favorable prices.

Some notable acquisitions and investments made by Berkshire Hathaway include Geico, Coca-Cola, American Express, and See’s Candies, household name now. These astute moves significantly contributed to Berkshire Hathaway’s growth and solidified Buffett’s reputation as a skilled capital allocator.

Transforming Berkshire Hathaway into a Global Conglomerate

Over the years, Buffett expanded Berkshire Hathaway’s reach beyond the confines of traditional industries. Today, it encompasses a wide range of businesses, including insurance, railroads, utilities renewable energy, manufacturing, and retail. Buffett’s ability to identify and capitalize on lucrative investment opportunities in a diverse range of sectors has transformed Berkshire Hathaway into a global conglomerate with a vast portfolio of companies.

The Berkshire Hathaway Annual Shareholder Meetings: A Carnival of Knowledge

The Pilgrimage of Investors

Every year, thousands of investors from around the world make the journey to Omaha, Nebraska, to attend the Berkshire Hathaway Annual Shareholder Meeting. This pilgrimage is a testament to the profound influence Buffett has had on investors, who eagerly seek to learn from his wisdom.

The Wisdom Dispensed at the Meetings

The Berkshire Hathaway Annual Shareholder Meeting is not just a gathering of investors but a treasure trove of knowledge. Buffett, along with his long-time business partner Charlie Munger, fields questions from shareholders, shares insights into his investment decisions, and provides valuable guidance on a wide range of topics. The meetings offer a unique opportunity for investors to gain valuable insights and learn from the investment master himself.

A Unique Blend of Education and Entertainment

The shareholder meetings have gained a reputation for their unique blend of education and entertainment. Buffett’s wit, humor, and folksy storytelling style have made the meetings engaging and enjoyable for attendees. While the primary focus is on discussing investment matters, the meetings also give such opportunities to showcase the values and culture that have made Berkshire Hathaway a remarkable success story.

Giving Back: Buffett’s Charitable Pursuits

Sharing the Wealth Beyond his investment success, Buffett has become known for his philanthropic endeavors. Rather than using the term “philanthropy,” Buffett prefers to describe it as “sharing the wealth.” He firmly believes in using his wealth to make a positive impact on society.

In 2006, Buffett made headlines when he pledged to donate the majority of his wealth to charitable causes, primarily through the Bill & Melinda Gates Foundation. This commitment, known as the Giving Pledge, has inspired other billionaires to follow suit, encouraging a culture of giving among the world’s wealthiest individuals.

The Power of Giving

Buffett’s philanthropic pursuits underscore the immense power of giving back to society. Through his contributions to philanthropic causes, he supports causes such as education, healthcare, poverty alleviation, and disaster relief. By directing his wealth towards these endeavors, Buffett aims to create a lasting impact and improve the lives of millions of people.

Buffett’s Vision for a Better World

Buffett’s vision for a better world extends beyond financial donations. He actively encourages individuals to engage in philanthropy and make a positive difference in their communities. Buffett believes that true fulfillment comes not only from financial success but also from using one’s resources to help others and create a better society.

The Buffett Effect: Lessons for Investors

Investing in Undervalued Companies

One of the most significant lessons investors can learn from Buffett is the importance of investing in undervalued companies. By diligently researching businesses, analyzing their fundamentals, and determining their fair price and intrinsic value, investors can identify opportunities where the market has mispriced assets. This approach allows for the potential to generate substantial returns over the long term.

The Importance of Research and Due Diligence

Buffett’s success is a testament to the value of thorough research and due diligence. He spends a significant amount of time analyzing financial statements, studying industries, and market trends and understanding a company’s competitive advantages before making investment decisions. This disciplined approach highlights the importance of making informed choices based on a solid understanding of the underlying businesses.

The Art of Patient Investing

Patience is a virtue in investing, and Buffett epitomizes this principle. He has repeatedly emphasized the significance of holding investments for the long term and resisting the temptation to trade frequently based on short-term market fluctuations. Buffett’s patient approach allows him to capitalize on the compounding effect of long-term investment returns and realize the full potential of his investments.

Succession Planning: Buffett’s Legacy in the Making

The Future of Berkshire Hathaway As Buffett enters the later stages of his career, succession planning has become a crucial consideration. The future leadership of Berkshire Hathaway will determine the company’s direction and the preservation of Buffett’s investment philosophy. Shareholders and the investment community eagerly anticipate the next chapter in Berkshire Hathaway’s journey.

Identifying Buffett’s Successor

Buffett has been deliberate in his efforts to identify a suitable successor who will carry on his investment legacy. While he has been tight-lipped about specific candidates, he has emphasized the importance of finding an individual who shares his investment principles, possesses integrity, and has the ability to steer Berkshire Hathaway successfully.

Ensuring the Long-Term Sustainability of the Buffett Legacy

Buffett’s legacy extends beyond his own lifetime. Ensuring the long-term sustainability of his investment principles and values is crucial to maintaining Berkshire Hathaway’s success. By nurturing a culture that aligns with his core principles and investing philosophies, Buffett aims to secure the future prosperity of the company and its stakeholders.

Final Thoughts

Warren Buffett: The Man Behind the Money

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” – Warren Buffett

Warren Buffett’s investment mastery goes beyond his financial achievements. He is revered not only for his exceptional investment skills but also for his humility, integrity, and commitment to philanthropy. His life journey serves as an inspiration, illustrating the transformative power of knowledge, perseverance, and a long-term perspective.

The Enduring Wisdom of an Investment Guru

Buffett’s enduring wisdom continues to shape the investment landscape and inspire generations of investors. From his emphasis on value investing to his patient approach and focus on giving back, Buffett’s principles offer valuable and important lessons even for those seeking success in the world of finance. Embracing these principles can guide investors toward achieving their financial goals and making a positive impact on society, mirroring the remarkable legacy of the Oracle of Omaha himself.

FREQUENTLY ASKED QUESTIONS ABOUT WARREN BUFFETT

When did Warren Buffett became a billionaire?

Despite being a highly successful investment CEO, Warren Buffett’s journey towards billionaire status was a gradual progression rather than an overnight success. It took until 1985, a full 20 years after his acquisition of Berkshire Hathaway, for the culmination of his diverse investments and businesses to propel his net worth to an impressive $1 billion.

What is Warren Buffett age?

92 years old

What is Warren Buffett net worth?

116.9 billion USD