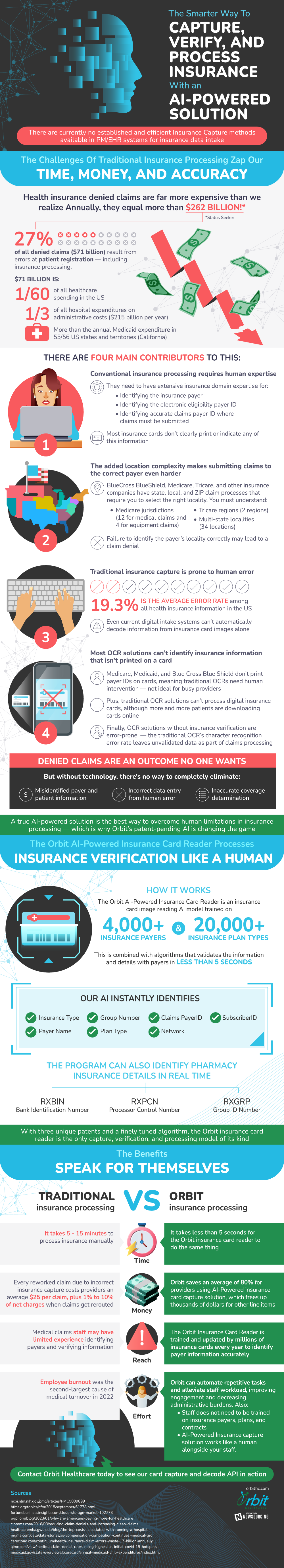

There are a lot of intricacies to be mindful of when submitting a health insurance claim- otherwise, there is a high chance it will be denied. Denied health insurance claims are actually very common, costing $262 billion annually. 27% of these, which is approximately $71 billion, are caused by mistakes made at the patient registration process. This means that the claim might have been worthy of being approved, but simple bits of information were either missing or misrepresented.

There are several reasons why so many patient registration mistakes are committed. The traditional methods of submitting a claim mostly rely on manual input, which increases the risk of human error. Employees need to be highly trained in the process of locating important information such as insurance payer information and claim submission sites. It is typically rather difficult to locate this information, because it is not frequently located on an insurance card.

These difficulties are made worse by the complex geographical criteria that big insurance companies like BlueCross Blue Shield, Medicare, and Tricare require. They make it imperative to select the precise locality, as there are specific state, local, and ZIP claim processes. For example, there are 12 Medicare medical jurisdictions and 34 multi-state localities, which is a lot to keep track of. Any mistakes can lead to an outright denial of the claim.

Artificial Intelligence (AI) solutions are hailed as the way to overcome these limitations in the insurance claims process. The goal of these AI systems is to lower the possibility of incorrect coverage calculations, misidentification, and data entry errors. These AI systems. were trained on enormous datasets with thousands of insurance card data points. They are able to validate information like insurance kind, payer name, and plan type in only five seconds. This indicates a significant improvement over the manual processing time of five to fifteen minutes.

Beyond speed, AI solutions save a lot of money; it costs $25 on average to manually complete modified claims. By guaranteeing accurate data on the first try, the application of AI has the potential to save providers up to 80% on processing costs. These changes in speed and accuracy brought on by these AI-powered platforms have the potential to completely transform the insurance claims sector. Within a few years, AI will be reducing errors, expediting processing, and giving healthcare providers significant financial advantages as they become more integrated with the industry.

Source: OrbitHC