Credit card debt has been on the rise nationwide, but analyzing state data reveals significant disparities between urban and rural usage and reliance on plastic. This article will delve into the key differences and provide insights into why city dwellers tend to carry higher card balances.

The Ballooning National Credit Card Debt

On a national level, American consumers are accumulating record-high credit card debt. As per the Federal Reserve, total revolving credit card balances reached over $1 trillion in 2022 for the first time ever. This denotes an 18% increase from 2021. Experts attribute this ballooning debt to reduced financial caution post-pandemic, higher costs of living, and riskier card products that encourage greater spending.

Several concerning trends underlie the growth. 65% of credit card holders carry debt from month to month, while late payments on accounts rose to 2.7% in Q2 2022. Average APRs also hit record levels of around 20%.

All indicators point to worsening reliance on credit cards among consumers nationwide. Credit report information and trends reveal the complex financial landscape that many individuals are navigating today. Interestingly, data shows that average credit scores by age tend to decline as consumers enter their peak spending years, contributing to riskier borrowing behaviors.

State Rankings Show Disparate Debt Levels

Drilling down to individual states reveals significant variation in average credit card debt and consumer behavior carried by consumers in different areas of the country.

According to 2022 data from credit rating agency Experian, states like Alaska, Hawaii, and New Jersey top the rankings for the highest average balances at over $7,000 per person. More frugal states like Kentucky and Wisconsin showed the lowest average credit card debt and consumer behavior below $5,000.

Generally, Western and Northeastern states with higher costs of living tend to have greater credit card debt and consumer behavior compared to the Midwest and Southern regions. A heat map of the U.S. illustrates the concentrated pockets of high credit card debt and consumer behavior along the coasts.

Credit Card Usage and Balance Patterns

Credit usage, utilization ratio, and credit balance are the key factors in estimating users’ creditworthiness. Whereas, credit balance plays a major role based on which, your issuer will approve your credit amounts. Here is a pictorial representation of the balance patterns among a set of survey attendees.

Urban Populations Shoulder More Card Debt

Within each state, a look at urban versus rural debt statistics confirms that those in metropolitan areas carry substantially higher credit card balances.

- In Texas, the average urban debt in cities like Austin is $2,000 greater than in non-metro areas.

- New York City residents owe twice as much on cards compared to other parts of the state.

- Chicago suburbs carry 29% more credit card debt than other Illinois cities or rural regions.

- Coastal urban hubs in California like Los Angeles and San Francisco vastly outpace inland areas.

This indicates that those residing in major financial centers rely more heavily on credit cards to afford higher urban costs of living. Rural regions exhibit more conservative usage.

Why the Urban-Rural Credit Card Debt Divide Exists

Several factors drive the consistent gaps observed between urban and rural credit card debt:

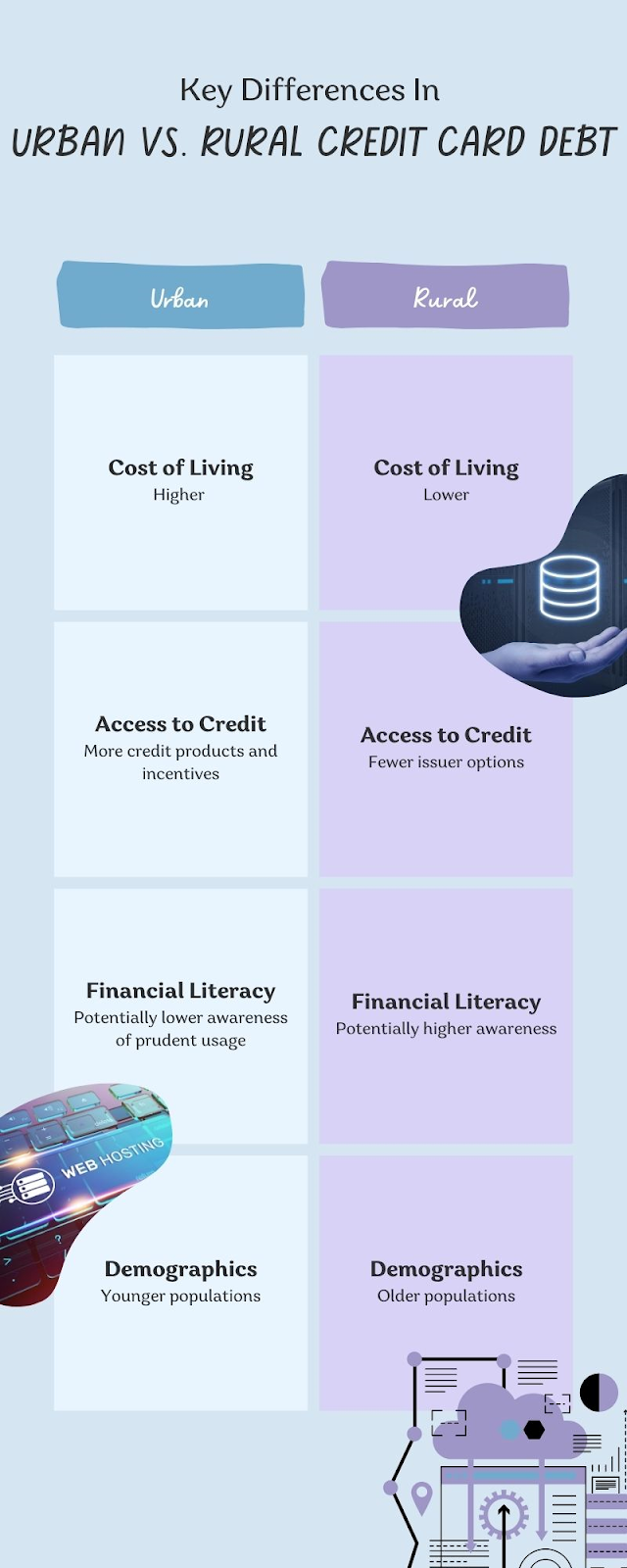

Key Differences in Urban vs. Rural Credit Card Debt

- Cost of Living – Major metros have significantly higher costs for housing, transportation, groceries, and utilities. This leads to dependence on cards for purchases.

- Access to Credit – Cities have more choice and competition between card issuers. Rural consumers have fewer products and incentives.

- Financial Literacy – Urban communities may have a lower awareness of prudent card usage and debt management.

- Demographics – Younger populations predominating in cities may exhibit riskier financial behaviors.

These drivers result in riskier reliance on credit cards to supplement finances in high-cost urban areas.

Reining in Dangerous Credit Card Debt

Regardless of geography, consumers must take steps to reduce dependence on credit card debt where possible:

- Closely monitor card spending and look for wasteful leakage

- Transfer balances to lower APR cards and negotiate lower rates

- Seek credit counseling and assistance with debt payoff plans

- Build emergency savings as a buffer against debt reliance

Prudent use of credit cards backed by financial awareness can help individuals across the urban-rural divide manage expenses wisely and avoid precarious debt levels.

Outlook for the Urban-Rural Divide in 2023

Looking ahead, the gap between urban and rural credit card debt is likely to persist and potentially widen if the cost of living in cities continues to rise faster than in other areas.

However, sound budgeting and a conscious reduction of card reliance can help all consumers get their balances trending down over time. Monitoring regional statistics will illuminate whether stratified urban-rural patterns in debt levels endure through 2023 and beyond.

FAQs

1. Which states currently have the highest average credit card debt?

Hawaii, Alaska, New Jersey, Connecticut, and New York top the list as per 2022 data from Experian. The Western and Northeastern states tend to have higher debt.

2. How can consumers reduce reliance on credit cards?

Monitor spending closely, transfer balances to low-rate cards, consolidate debts into installment loans, seek credit counseling, and build emergency savings.

3. Will urban credit card debt continue rising faster than rural debt?

Likely yes, if the cost of living in cities keeps increasing disproportionately. However prudent financial habits can help mitigate dangerous debt levels.

Final Thoughts

In conclusion, the analysis of urban and rural credit card debt patterns in 2023 highlights concerning trends in the United States.

National credit card debt has soared due to post-pandemic financial recklessness, rising living costs, and riskier card products. State-level data shows significant disparities, with urban areas carrying higher debt burdens, driven by factors like cost of living, access to credit, financial literacy, and demographics.

While the urban-rural debt divide is expected to persist, responsible financial practices can help individuals reduce their reliance on credit cards. Monitoring regional statistics will be crucial.

Overall, the data underscores the need for financial awareness, prudent spending, and proactive debt reduction strategies for individuals across the urban-rural spectrum to navigate the credit card landscape wisely and avoid dangerous debt levels.