Marijuana has gone a long way from a demonized, illicit drug to a part of the USA’s mainstream recreational culture and medical practice. Over 30 states have already legalized weed use for medical purposes, and the number of recreational weed-friendly states is reaching 20. Thus, smoking weed, eating weed-infused products, and administering CBD extracts are no longer illegal, stereotyped practices. Now every businessperson can open a marijuana dispensary near their houses and sell weed products without fearing legal trouble.

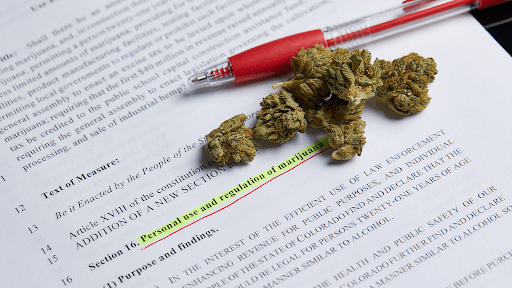

One should keep in mind that the weed business is strictly regulated, even in fully legalized jurisdictions. The set of laws and regulations is very diverse, making the weed industry a headache. Still, if you’re interested in this niche and want to consider opening your dispensary, it’s better to study all legislation and documentation inside out, saving yourself from hassle. Here we cover the weed business geography and shed light on the main considerations and paperwork for opening a legal dispensary.

Early Adopters

California was the first state to legalize cannabis in 1996. The 26-year-old decision has ensured that the state already has a mature, well-functioning weed industry. Next came Alaska, Nevada, Oregon, and Washington in 1998. Maine legalized weed in 1999, and Colorado followed the lead in 2000. In all these states, both medical and recreational weed is legal.

Next came Montana, Vermont, Rhode Island, New Mexico, Michigan, and Hawaii. In all those states, the legalization took place in 2000-2008 for medical marijuana use. Recreational use was legalized much later – in 2020-2022- and Hawaii remains negative about recreational weed.

The list of states that legalized medical weed from 2010 until the present moment is as follows:

- Arizona (2010)

- New Jersey (2010)

- Delaware (2011)

- Connecticut (2012)

- Massachusetts (2012)

- Illinois (2013)

- Maryland (2013)

- New Hampshire (2013)

- Minnesota (2014)

- New York (2014)

- Georgia (2015)

- Louisiana (2015)

- Arkansas (2016)

- Florida (2016)

- North Dakota (2016)

- Ohio (2016)

- Pennsylvania (2016)

- Iowa (2017)

- West Virginia (2017)

- Missouri (2018)

- Oklahoma (2018)

- Utah (2018)

- Mississippi (2022)

- South Dakota (2020)

- Virginia (2020)

- Alabama (2021)

While all these states allow medical marijuana use, not many consider recreational marijuana legal. In this respect, the list of states is much shorter, and the legalization occurred much later than that for medical weed use:

- Arizona (2020)

- New Jersey (2020)

- Connecticut (2021)

- Massachusetts (2016)

- Illinois (2019)

- New York (2021)

- Virginia (2021)

Licensing for a Weed Enterprise

Those who plan a weed business should remember that the venture may turn out pretty costly. Like tobacco and alcohol, weed is a “sin business,” so it’s charged very high “sin taxes.” In some states, you will have to share up to 60% of your earnings with the state, and the license costs get pretty high in many jurisdictions. Here is a quick glance at the patchwork of licensing and taxation regulations in the USA, clarifying how much a dispensary can cost.

- In New York, the new weed enterprise will cause from $500,000 to $1,000,000 because of the licensing fees. The NY Office of Cannabis Management (OCM) regulates the weed business in the state and issues licenses. The license costs include a $10,000 application fee and a $200,000 registration fee for approved licenses. Once you get the license, it may cover up to 4 dispensaries.

- In Virginia, businesspeople should apply for a “Pharmaceutical processor Permit” to the Virginia Board of Pharmacy. The applicants are charged a non-refundable $10,000 application fee and pay for the initial permit fee of $60,000 if their application gets approved.

- The dispensary licensing rules work pretty differently in Oklahoma. Here, the businesses are charged processor license fees from $2,500 to $40,000, depending on their size and weed sales volumes. Dispensaries must also pay an annual fee from $2,500 to $10,000, calculated based on their annual sales volume.

- California is one of the most expensive states for opening and running a weed business. However, its regulations are pretty flexible and allow small businesses to function without breaking the bank. The distribution license fees range from $1,500 to $240,000, depending on the business size. A distributor license (which covers only transportation and self-distribution) is $200-$1,000. Retailers will have to pay from $2,500 to $96,000), and the license costs for micro businesses can reach $300,000.

Considerations for Opening Your Weed Business

As you can see, each state poses different regulations and licensing fees for weed business owners. Successful licensing depends on how you prepare all paperwork and organize the security plan for your dispensaries. Keep in mind that the application fee is non-refundable, so you can easily lose up to $10,000 because of neglect of some vital licensing prerequisites.

Thus, we recommend studying all recommendations and regulations of your state’s relevant department working with weed business licensing. You should prepare the full documentation package in line with their checklist and present a well-designed business plan to get registered successfully.