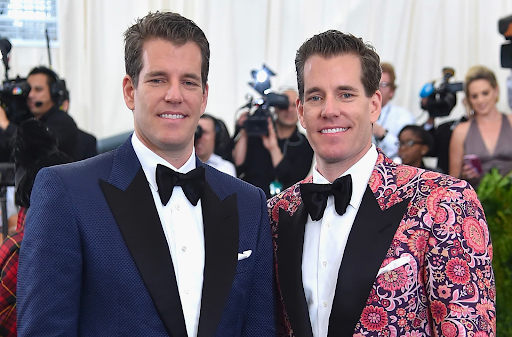

The cardinal trait of many successful entrepreneurs is reinvention. An ability to reinvent their business models and skill sets at will to adapt with the times. Welp, you can definitely assume Tyler and Cameron Winklevoss, better known as the Winklevoss, have that trait deep in their DNA.

The Winklevoss have been in the limelight for about 15 years now — for various-different reasons. It started with their athletic feats that were available for online betting in Texas and the whole world for that matter. It’s stretched now to crypto, which some equate to gambling too. It’s been an incredible journey and one worth exploring for those wanting to trek down the entrepreneurial journey.

Rowing Olympians

The Winklevoss twins first claim to fame was through rowing. The two took up the sport when they were 14. They continued even after being accepted to Harvard University. Despite rigorous studies, the brothers competed for the university and even reached the highest level — the 2004 Intercollegiate Rowing Association Regatta, the men’s national championship.

This led them to representing the United States at the 2008 Summer Olympics in Beijing. Out of 14 boats, the Winklevoss twins placed sixth overall, missing out on a medal altogether.

The pair continued training, even whilst they studied for masters degrees at the University of Oxford. It felt like a perfect location since the 2012 Olympics would be held in London. However, the pair gave up the Olympic pursuit near the end of 2011, partially because they were older and partially because they were enriched by other means, which we’ll cover next.

Facebook Lawsuit

Ah, yes, The Facebook incident (back when the company still had the in its name). The Winklevoss were portrayed in the 2010 movie, The Social Network, by Armie Hammer. The movie depicts how Mark Zuckerberg founded the company whilst at Harvard. It also depicts the Winklevoss as the original ideators of a college-only social network.

Both in the movie and in real-life, the Winklevoss’ sued Zuckerberg over the whole ordeal. Eventually, Zuckerberg had to pay out $65 million in a settlement. That sum of money was dealt in 2008, two years before the movie’s release, which was an Academy Award darling.

That’s a nice chunk of change on the surface, but it’s peanuts given that Facebook — or Meta as it’s been renamed — has a market cap of $450 billion right now. As a giant shareholder, Zuckerberg is estimated to be worth $60 billion in his own right. But don’t feel bad for the Winklevoss’, they found their own path to earn a billion.

Crypto Billionaires

These days — and for the better part of a decade — the Winklevoss have quite literally gone “all in” on cryptocurrency. Using some of the settlement money from Facebook, the twins invested heavily in the space and it paid off. We mean, Bitcoin was the single-best performing asset of the last decade and Winklevoss recognized the opportunity early.

Back in 2012 and 2013 — long before crypto was known to the masses — brothers announced they acquired $11 million in Bitcoin through their own Winklevoss Capital fund. No one knows for sure how much that stake they still own or how much it’s fully worth now, but most assume it’s a huge sum well into the billions.

But the Winklevoss aren’t just investing in the space, they’re also creating. They founded Gemini in 2014, which is a centralized exchange that allows users to buy crypto. In a space that’s seen many go bankrupt — Celsius and Voyager, most recently — Gemini remains in-business around the world.

A few years ago, the brothers also acquired Nifty Gateway, another centralized platform but this time for NFTs. If you really look at the Winklevoss moves from a macro view, they’re controlling how everyday users “on ramp” into crypto, whether that’s through buying coins or NFTs. While crypto continues to gain adoption, on-boarding users is a great place to be in.

Even with crypto prices in the dumps right now, it seems like the Winklevoss are still billionaires. They were early on crypto before it was cool and are well-positioned to reap the industry’s future growth.