Writing financial emails can feel intimidating. Money is a sensitive topic, and how you communicate about it makes a big difference.

Whether you are sending updates, reminders, or important notices, the way you write can build trust or create confusion. Good financial emails are clear, polite, and easy to follow.

They don’t need to be long, but they should always be respectful and professional.

Why Clarity is So Important

Financial emails often deal with numbers, dates, and instructions. If you are unclear, the reader may miss something important.

For example, if you are sharing a payment deadline, you need to state the exact date, time, and method. If you are providing an update about an account, use plain language so the person doesn’t get lost in jargon.

Clarity also helps avoid mistakes. A vague subject line like “Update” might be ignored, while “Your Account Statement for September 2025” tells the reader exactly what to expect.

Writing in simple sentences can prevent misunderstandings, especially if the person is busy or reading quickly.

Tone and Professionalism

Money conversations can cause stress, so your tone should be calm and respectful. Avoid sounding too casual, but don’t be overly stiff either.

Striking the right balance shows that you care about the reader while still keeping it professional.

For example, instead of saying “Hey, don’t forget to pay up,” write “This is a reminder that your payment is due on September 15.” It communicates the same message but in a way that sounds more trustworthy.

Small details like a polite greeting, a thank-you, or a closing line make your message feel complete.

Examples of Effective Writing

Seeing financial email examples can help you understand what works. A good example might start with a clear subject line like “Payment Reminder: Invoice #4567 Due September 15.” The opening sentence could confirm the amount and due date.

The body should explain how to make the payment and who to contact with questions. A closing line like “Thank you for your prompt attention” wraps it up politely.

Another example could be a monthly account update. The subject line might be “Your Monthly Account Summary.”

The email could include the opening balance, deposits, withdrawals, and ending balance. Instead of adding long explanations, use short, clear sentences. You can also add a link where the person can log in for more details.

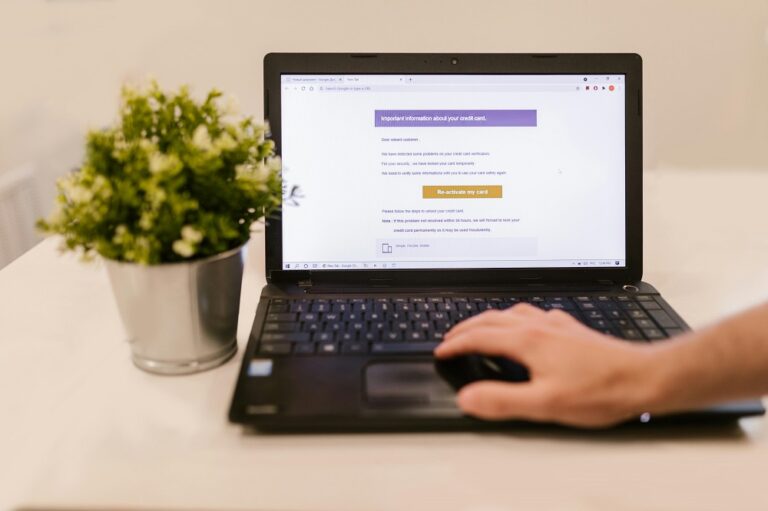

When writing about sensitive topics such as overdue payments, your wording matters even more.

A professional example might begin with: “We noticed that your payment due on August 30 has not been received.” This states the fact without being harsh.

Then you can provide options for resolving the issue, such as different payment methods or a phone number for assistance.

How to Structure Your Emails

A good financial email has three parts: the subject line, the body, and the closing. Each plays an important role.

The subject line should always tell the reader what the email is about. Avoid vague words like “Notice” or “Important.” Instead, be direct. For example: “Action Required: Confirm Your Bank Details.”

The body should cover the main point quickly. Use short paragraphs or bullet points if there is a lot of information. Don’t bury the key detail at the end. If you’re writing about a payment, state the amount and date in the first few lines.

The closing should include your name, contact details, or the company signature. Adding a polite phrase such as “Please contact us if you have questions” shows you are open to communication.

Tips for Better Results

Before sending a financial email, always read it again. Look for spelling mistakes, missing details, or confusing sentences. Double-check numbers and dates, since errors can cause serious problems. If possible, test the links in your email to make sure they work.

Formatting also helps. Use bold text for key details like dates or amounts, but don’t overdo it. A clean layout makes your message easier to read, especially on a phone.

Lastly, think about timing. Sending reminders too often can annoy people, but sending them too late is risky. Find a balance that works for your audience.

Conclusion

Writing financial emails doesn’t have to be complicated. The key is to keep them clear, polite, and well-structured.

Focus on what the reader needs to know and present it in a straightforward way. By paying attention to tone, accuracy, and layout, you can build trust and avoid confusion.

Whether you are sending a reminder, a monthly update, or a notice about payments, a well-written email helps people feel informed and respected.