For decades, real estate companies measured success primarily in terms of square footage, financing, and returns. But in today’s digital first market, one of the most valuable yet overlooked asset classes is reputation. From investment confidence to community approval, reputation now exerts direct influence on valuations—and, according to industry surveys, 78% of investors admit that negative media or weak digital visibility can reduce perceived property value, even when fundamentals remain strong.

In this shifting environment, public relations is no longer a peripheral marketing function—it is infrastructure. Just as developers allocate capital to land acquisition or design, they must now allocate strategic capital to PR as a means of protecting and growing long-term value. Reputation doesn’t just drive faster sales; it also reduces friction with regulators, improves financing terms, and ensures that online discovery platforms—now the first stop for many stakeholders—surface the most favorable version of a firm’s narrative.

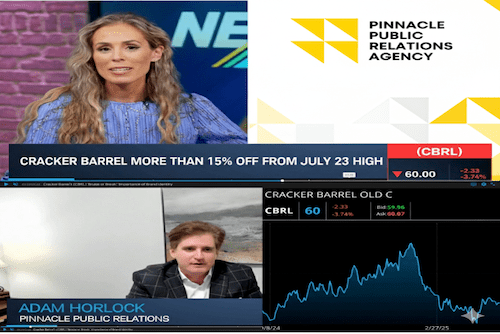

“Real estate leaders have always known that perception shapes markets,” said Adam Horlock, Founder and Chief Strategist at Pinnacle Public Relations Agency. “What’s changed is the velocity and permanence of those perceptions in an AI-powered ecosystem. Today, every headline, every press release, every executive quote feeds a machine that influences billions in real estate decisions. That means reputation has to be managed with the same rigor as capital—it compounds over time, but it can also be eroded overnight if neglected.”

The Financing Advantage of Reputation

One of the least discussed benefits of a strong reputation strategy in real estate is its impact on financing terms. Lenders and institutional investors increasingly view media presence and public trust as indicators of stability, often rewarding firms with better rates and faster approvals when their leadership is consistently profiled in reputable outlets. In fact, a recent CBRE Capital Markets survey found that 62% of investors weigh brand credibility and public visibility when assessing long-term partnerships. By approaching PR as a form of “reputation collateral,” developers can unlock not only sales velocity but also access to more favorable capital structures—turning their public image into a financial advantage.

Final take

Pinnacle’s guidance emphasizes that reputation, unlike traditional assets, compounds at scale. A single well-placed feature article or authoritative executive profile may be indexed, quoted, and summarized endlessly by generative search tools, magnifying its reach far beyond initial publication. Conversely, a lack of presence—or worse, outdated or conflicting narratives—creates gaps that competitors or critics can easily fill. For firms managing billion-dollar portfolios, that makes PR not just an asset, but a safeguard.