Starting a business is never a smooth path. For many mission-driven founders, money becomes the stumbling block, especially when past credit issues loom over current plans. Yet a less-than-perfect score does not have to mean the end of an idea worth pursuing.

Entrepreneurs who want to keep their projects alive still have options. Creative approaches to financing are opening doors for people once shut out of traditional banks. It is possible to access loans even with poor credit score histories and still move forward with purpose. The key lies in knowing which alternatives to explore, how to use them responsibly, and keeping your values at the core of financial decisions.

Why Credit Isn’t the Whole Story

Credit scores matter, but they do not define entrepreneurial potential. Banks lean heavily on numbers when deciding whether to lend. That system leaves many capable and creative leaders without the resources they need. Entrepreneurs often carry debt from past ventures or face cash flow challenges that hurt their records.

But investors, communities, and new lending platforms are shifting the narrative. They recognize that character, mission, and sound business plans can outweigh a single number on a report. This broader view gives founders space to find support without being trapped by history.

Installment Loans for Predictable Payments

One route worth considering is the installment loan. Unlike revolving credit cards, installment loans come with a fixed amount, clear repayment schedule, and end date. That predictability can be a relief for business owners managing tight budgets.

With steady monthly payments, it is easier to track expenses and plan cash flow. These loans may be available even if a credit score is low, as long as income or collateral demonstrates ability to repay. They can cover equipment purchases, marketing pushes, or early staffing needs.

Unsecured Personal Loans

Another option is the unsecured personal loan. These do not require putting property or business assets on the line. While interest rates may be higher than those for secured loans, the flexibility can be worth it.

Founders often use personal loans to bridge short gaps. For example, covering a bulk order of materials, paying for a trade show booth, or smoothing payroll before client invoices clear. Used wisely, they provide breathing room without long-term entanglements.

Loan-Matching Platforms

Digital platforms that match borrowers with lenders are becoming a lifeline for many. Instead of filling out multiple applications, entrepreneurs can submit details once and review a range of offers. Some services even work with lenders who consider more than just credit scores.

These platforms save time, reduce stress, and increase the odds of finding fair terms. For entrepreneurs who value transparency, they also create an environment where lenders must compete, which often results in better deals.

Peer-to-Peer Lending

Peer-to-peer lending connects individuals who want to invest with people who need funding. It has become a community-driven alternative that fits well with ethical entrepreneurship. Lenders earn returns while supporting ventures that resonate with their values. Borrowers, in turn, may find more understanding terms than traditional institutions provide.

For mission-focused leaders, peer-to-peer platforms can align financial goals with the spirit of collaboration and mutual growth.

Crowdfunding with Purpose

Crowdfunding continues to thrive as an avenue for raising money without relying on credit. Platforms dedicated to business funding allow entrepreneurs to pitch their story directly to supporters. Campaigns that clearly show how a venture will make a positive impact tend to attract backers.

This path not only raises funds but also builds a loyal community of early customers and advocates. It proves that purpose and profit can move together.

Building Trust While Borrowing

No matter which funding path you choose, trust remains the foundation. Being upfront with lenders, backers, or investors about how money will be used builds credibility. Delivering on promises reinforces that trust.

Ethical entrepreneurs know that money is not just a tool for survival. It reflects how they value people, partnerships, and their own integrity. Even in times of financial challenge, holding to those principles pays off in the long run.

Practical Tips for Staying Grounded

While exploring creative financing, it is important to avoid falling into traps. A few simple steps can make a big difference:

- Compare terms from multiple lenders before signing anything

- Read the fine print for hidden fees or penalties

- Use borrowed funds for business growth, not day-to-day living costs

- Track repayment schedules to avoid unnecessary stress

Staying disciplined helps ensure that borrowing supports your vision instead of weighing it down.

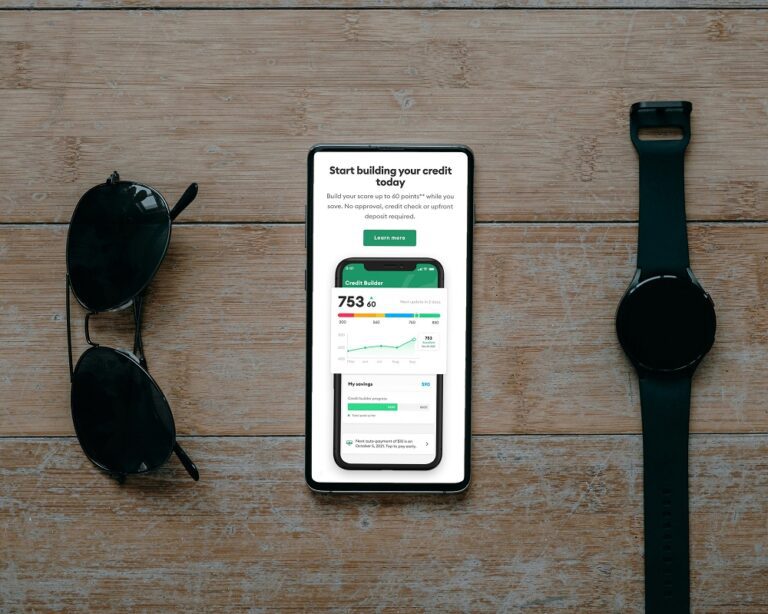

Photo by Jonathan Borba

The Bigger Picture

Every entrepreneur faces challenges. Credit struggles are simply one chapter in a longer story. What defines ethical leaders is not the number on a report but the persistence to find solutions without cutting corners.

With installment loans, unsecured personal loans, loan-matching platforms, peer-to-peer connections, and crowdfunding, doors stay open. These options allow mission-driven founders to keep moving, keep creating, and keep serving their communities.

Bad credit does not have to silence good ideas. With creativity and care, ethical entrepreneurs can secure funding, honor their values, and prove that business success is about more than a score.