In today’s dynamic business environment, effective financial management and streamlined operations are essential for success. With a growing number of innovative platforms, businesses now have access to powerful tools that can simplify processes, enhance financial health, and support growth. This listicle highlights four top platforms designed to transform how companies and individuals manage their finances and operations.

From automating cash flow forecasting to providing personalized financial coaching, these platforms are leading the charge in reshaping financial management. Let’s dive into how these companies are making an impact.

Birdview

Birdview is a comprehensive project management tool designed to grow with your business. It offers an intuitive platform that combines essential tools for resource planning, scheduling, forecasting, and more, ensuring that your team stays on top of tasks as your business scales. Whether you’re managing small projects or large-scale operations, Birdview provides the flexibility and scalability needed to adapt to changing business demands, with a particular focus on optimizing resources and timelines.

Key Features:

- Resource Planning: Efficiently allocate and manage resources to meet project requirements.

- Scheduling: Streamline project timelines and ensure on-time delivery.

- Forecasting: Predict project outcomes and make informed decisions based on data-driven insights.

- Customizable Workflows: Tailor workflows to suit specific project needs.

Suitable for: Businesses of all sizes looking to enhance project management, streamline workflows, and ensure successful project delivery, especially in industries like construction, IT, marketing, and consulting.

MoneyCoach

MoneyCoach is an innovative platform designed to help individuals manage their finances effectively. With a focus on reducing financial stress, MoneyCoach offers tools for tracking cash spending, managing personal budgets, and providing financial insights that empower users to make better financial decisions. This platform is deeply integrated with the Apple ecosystem, including support for Apple Vision Pro from day one, making it one of the best apps worldwide as highlighted by Apple. Additionally, it offers real-time multi-currency tracking, further enhancing its utility for global users.

Key Features:

- Expense Tracking: Keep a detailed record of all cash transactions and spending habits.

- Budget Management: Set and manage personal budgets to control spending.

- Multi-Currency Support: Track different currencies in real-time for accurate financial management.

- Apple Ecosystem Integration: Seamless functionality with Apple devices, including Vision Pro.

Suitable for: Individuals and families seeking to improve their financial management skills, reduce stress related to money, and achieve greater financial stability, especially those within the Apple ecosystem.

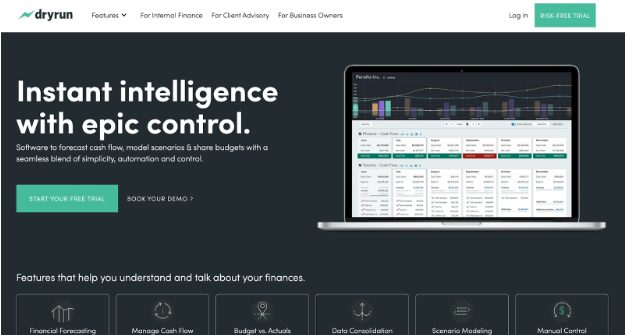

Dryrun

Dryrun offers a powerful solution for businesses to forecast cash flow, model various financial scenarios, and manage budgets with ease. It is particularly effective in replacing traditional CFO spreadsheets, which are often used for forecasting complex cash flow. By switching to Dryrun, businesses can save over 90% of the time they typically spend managing spreadsheets. Additionally, Dryrun equips CFOs and financial teams with crystal-clear forecasts that facilitate more effective discussions with management. Its intuitive interface and automation features make it easy to visualize financial data and explore different budgeting scenarios without the complexity of traditional methods.

Key Features:

- Cash Flow Forecasting: Predict and visualize cash flow over time to ensure financial stability.

- Scenario Modeling: Test different financial scenarios to plan for various outcomes.

- Budget Management: Create, adjust, and monitor budgets with ease.

- Resource Planning & Scheduling: Optimize resources and timelines to meet project demands.

Suitable for: Small and medium-sized businesses, particularly those in industries like retail, manufacturing, and professional services, looking to improve financial planning and cash flow management.

Your Money Line

Your Money Line provides a unique blend of empathetic human support and AI-powered tools to help employees manage their finances and reduce money-related stress. This platform is designed to be a comprehensive Financial Wellness Program for companies, aiming to improve employee well-being and, in turn, enhance overall workplace productivity. By offering personalized financial coaching and resources, Your Money Line helps employees navigate their financial challenges with confidence.

Key Features:

- Financial Coaching: Access to professional financial coaches for personalized advice.

- AI-Powered Tools: Utilize AI to analyze financial data and provide tailored recommendations.

- Stress Management Resources: Tools and tips to reduce financial stress and improve well-being.

- Employee Engagement: Enhance employee satisfaction and productivity through financial wellness support.

Suitable for: Organizations that want to offer financial wellness benefits to their employees, particularly in industries where financial stress is a leading cause of employee dissatisfaction and turnover, such as healthcare, education, and corporate sectors.

Expend

Expend is a powerful financial management platform designed to simplify expense management, invoicing, and financial tracking for businesses. It offers an all-in-one solution that integrates seamlessly with existing accounting systems, making it easier for companies to manage their finances efficiently.

Expend automates many of the tedious tasks associated with financial management, reducing the time spent on administrative work and allowing businesses to focus on growth.

Key Features:

- Expense Management: Streamline the process of capturing, tracking, and approving expenses.

- Invoicing: Generate and manage invoices with ease, ensuring timely payments and accurate financial records.

- Financial Integration: Seamless integration with popular accounting software, enhancing financial accuracy and reporting.

- Automation: Reduce manual data entry and automate repetitive financial tasks.

Suitable for: Small and medium-sized businesses that want to streamline their financial operations, improve expense tracking, and integrate their financial management with existing accounting systems.

Conclusion

These platforms are revolutionizing the way businesses and individuals manage their finances and operations. Leveraging advanced technology and user-centric design, they provide powerful tools to simplify processes, reduce stress, and support growth.

Whether you’re looking to enhance project management, improve personal financial health, or offer comprehensive financial wellness benefits to employees, these companies offer solutions that can help you achieve your goals.