In India, tax filing has long been associated with complicated forms, crowded CA offices, and stress around deadlines. But in the last few years, a significant shift has occurred. With the rise of mobile-first platforms, income tax return (ITR) filing has become simpler, more intuitive, and accessible to millions. In 2025, mobile apps are not just a convenience—they’re a revolution in how Indians manage their taxes.

This article explores the key reasons why mobile apps are transforming ITR filing and why more people—especially salaried individuals, freelancers, and small business owners—are moving toward app-based platforms.

Ease of Filing from Anywhere, Anytime

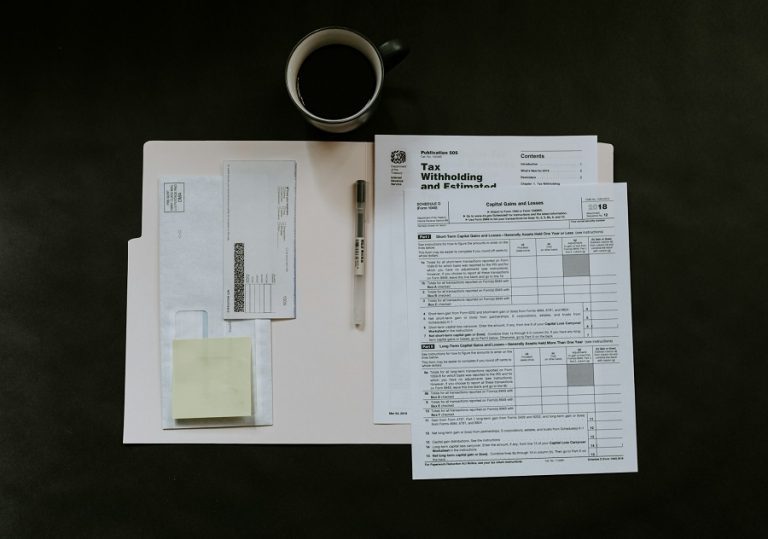

Gone are the days when tax filing required desktop computers or physical paperwork. With mobile apps, users can file their income tax returns directly from their smartphones—whether they’re at home, commuting, or even traveling. The flexibility of 24/7 access has made tax filing less time-bound and less location-dependent.

This on-the-go capability is particularly useful for salaried employees who often don’t have time to sit at a computer during working hours. Apps allow them to upload their Form 16, track deductions, and submit returns all during a coffee break or while in transit.

Intuitive Interfaces That Simplify Complexity

One of the major pain points of traditional ITR filing was the intimidating structure of forms like ITR-1, ITR-2, etc. Mobile apps have reimagined this experience with clean interfaces and user-friendly steps. Rather than asking users to fill out complex fields, most apps now operate using a guided journey.

Instead of asking users which form applies to them, good apps identify the right ITR form automatically based on the user’s income and documents. They also explain terms like standard deduction, Section 80C, HRA exemption, or capital gains in simple language.

This level of simplification has opened up tax compliance to a wider audience, especially first-time filers and gig workers.

Auto-Filled Data via Form 16 Upload

Another innovation that mobile ITR apps have brought to the table is the ability to upload Form 16 and extract relevant information instantly. This feature has proven incredibly useful for salaried individuals. Instead of manually typing income details, deductions, and tax deducted at source (TDS), the app does the work for you.

Some apps, such as TaxBuddy, offer auto-import features where users just upload their Form 16 once, and the entire return is pre-filled. This reduces data entry errors and saves time. It’s a major factor why salaried employees are increasingly trusting mobile apps over traditional manual methods.

Expert Help Is Now a Chat Away

While mobile apps simplify tax filing, users still have questions—especially when it comes to tax-saving investments, capital gains reporting, or deductions for home loans and insurance. Modern tax apps now integrate real-time chat or callback support from tax professionals or CAs.

Instead of visiting a tax consultant physically, users can connect with a professional directly through the app. Some platforms offer assisted filing where a CA reviews the entire filing before submission. This ensures both compliance and peace of mind.

Apps like TaxBuddy, for instance, blend automation with human expertise, offering a smoother, more accurate experience for users who want help but don’t want to rely on traditional consultancy setups.

Real-Time Tax Saving Suggestions

One of the biggest trends in 2025 is personalized tax planning. Good mobile apps now don’t just help you file your return—they help you save better. Based on your income profile and uploaded documents, these apps suggest possible deductions or tax-saving investments you might have missed.

For example, if your 80C investments are below the ₹1.5 lakh limit, the app might remind you to top up your PPF or ELSS before filing. It may also suggest health insurance under Section 80D or NPS investments under Section 80CCD(1B).

This proactive planning was missing in earlier web-based or offline models. Mobile apps have made tax filing smarter—not just easier.

Secure and Private Filing

A common concern among users has been the security of financial data. Modern tax filing apps are built with robust encryption, secure login protocols, and two-factor authentication to ensure your data stays protected.

Many platforms also offer OTP-based logins, biometric security, and cloud-based storage so that your return is accessible anytime but safe from unauthorized access.

Trusted apps undergo regular audits, are GDPR compliant, and adhere to data privacy standards, offering users the confidence to store PAN, Aadhaar, bank account, and salary details without worry.

Seamless Integration with Government Portals

The best tax filing apps in India now offer direct integration with the Income Tax Department’s systems. This means that once you submit your return through the app, it’s e-verified instantly, and acknowledgements (ITR-V) are generated in real-time.

Some apps also integrate AIS (Annual Information Statement) data and allow users to cross-check their Form 26AS without logging into the official site separately.

This tight integration makes the entire process—from filing to refund tracking—smooth, transparent, and fast.

App-Based Filing Is Ideal for Diverse User Profiles

Whether you’re a salaried employee, a freelancer working under Section 44ADA, a stock market investor dealing with capital gains, or a landlord earning rental income, mobile tax filing apps cater to every scenario.

Apps like TaxBuddy, ClearTax, and others now support ITR-1 to ITR-4, and offer extra help for those with business income or multiple income sources. The result is a more inclusive filing environment for India’s growing class of digital workers.

Fast Refunds and Easy Rectifications

Speed is another benefit. Mobile tax apps allow faster submission, quicker verification, and thereby faster refunds. Most salaried users filing through apps report getting their refunds within a couple of weeks—sometimes even sooner.

Additionally, if any discrepancy is found post-submission, apps allow quick rectification requests directly through the interface, without having to go through tedious government portals.

Notifications, Reminders, and Follow-Ups

Unlike traditional filing services that end once you submit your ITR, mobile apps maintain communication throughout the year. They notify you when returns are processed, when refunds are credited, and if any notices or updates arise from the tax department.

You also get annual reminders to invest in tax-saving instruments or pay advance tax if applicable. This consistent support improves tax compliance and reduces stress.

In Summary: The Future of ITR Filing Is in Your Pocket

The move to mobile is more than just a convenience trend—it’s a shift in how Indians interact with the tax system. With the power to upload documents, consult experts, review deductions, file returns, and receive refunds—all from a smartphone—users have taken control of their financial compliance.

While many apps offer great features, platforms that offer both guided support and expert help—without overwhelming the user—are leading the way in 2025. TaxBuddy is one such platform that blends simplicity with accuracy, automation with expert advice, and mobile-first design with year-round support.